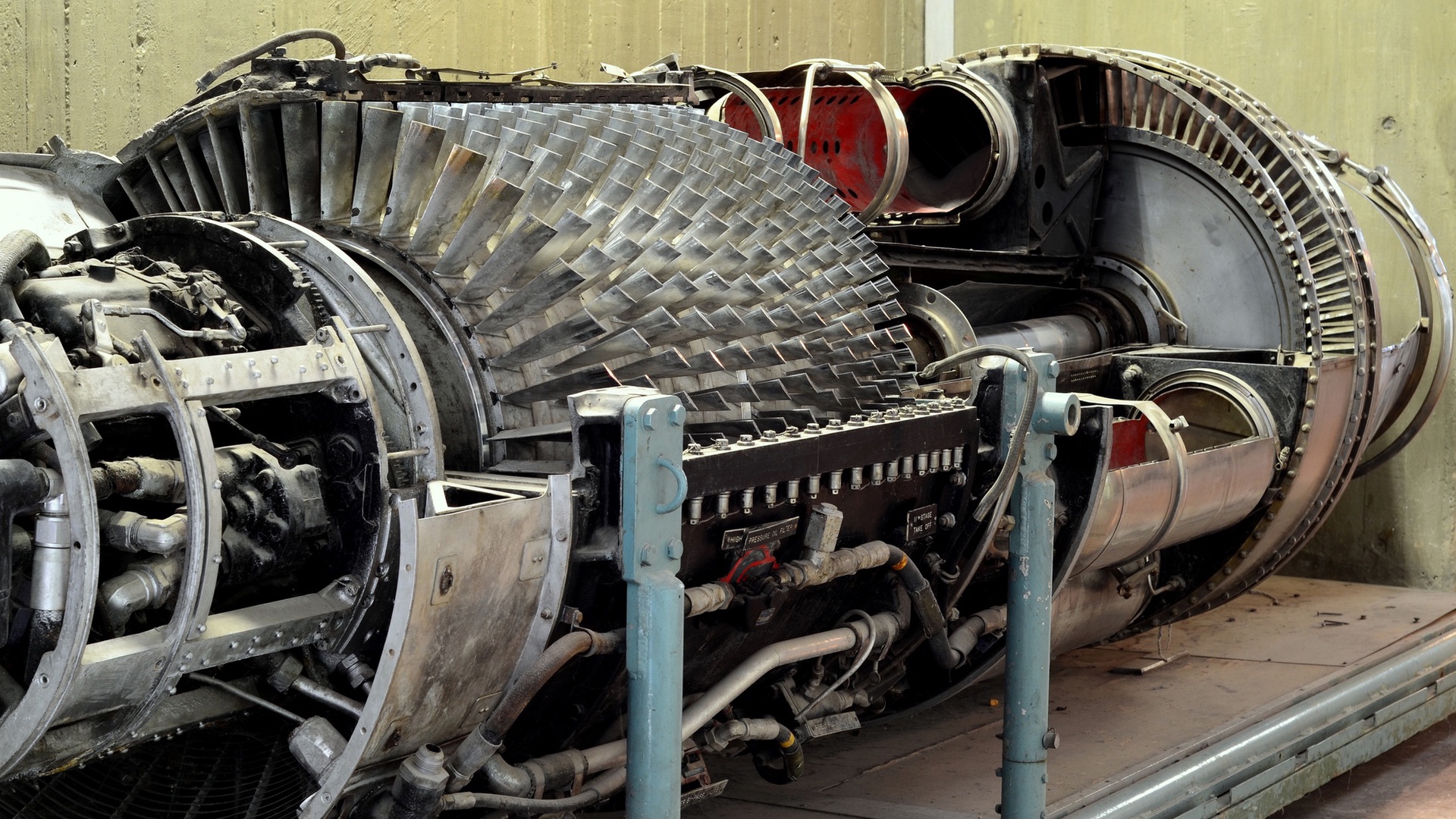

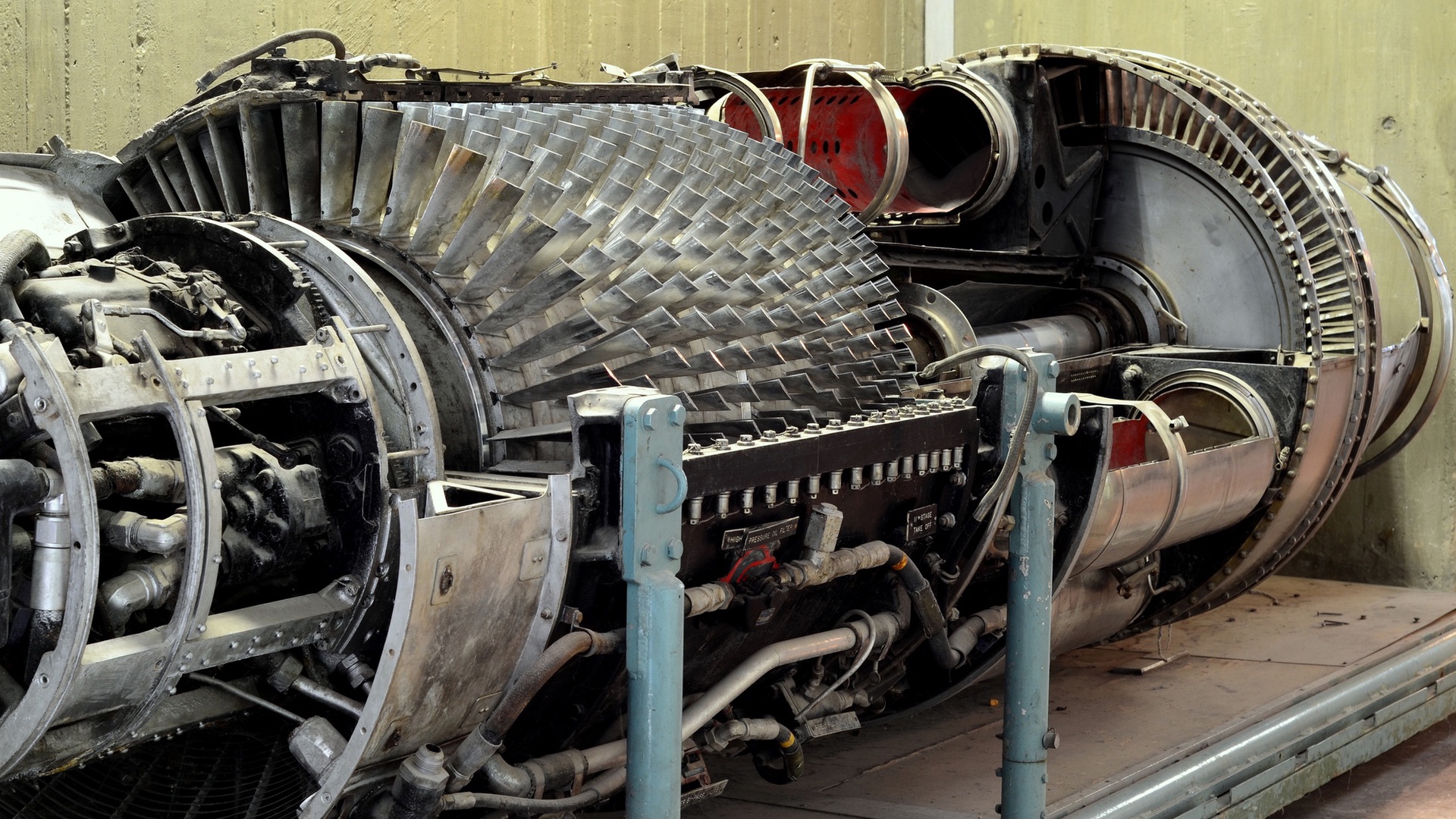

Rhenium’s unique attributes are vital across high-stakes industries. The aerospace sector consumes over 80% of global rhenium supply, primarily in nickel-based superalloys (3-6% rhenium) for jet engine components like turbine blades, vanes, and nozzles. This enables higher operating temperatures, improving fuel efficiency, thrust, durability, and operational life. Examples include René 41, CMSX-4, CMSX-10, and TMS-138.

The energy sector uses rhenium-containing superalloys in industrial gas turbines for power generation. In petrochemicals, platinum-rhenium bimetallic catalysts are crucial for “reforming” processes, converting lower-grade petroleum into high-octane gasoline. Rhenium enhances catalyst stability, efficiency, and coke resistance. While some sources indicate that over 60% of rhenium goes to catalysts, both the aerospace and petrochemical industries are its largest and most critical applications. Rhenium also finds use in rocket nozzles, X-ray tubes, electrical contacts, and thermocouples. Its ability to enable higher operating temperatures and enhance efficiency provides a competitive advantage, making it an irreplaceable enabler of modern technology.

Rhenium’s high value and scarcity mean that every potential source of scrap is a valuable resource. Identifying these sources is key to unlocking their economic and strategic potential.

The aerospace industry is the largest generator of rhenium-containing scrap. Jet engine turbine blades and other hot-section components, made from nickel-based superalloys with 3-6% rhenium, are decommissioned after their operational lifespan (around 10 years) or during MRO activities. This scrap includes used turbine blades and engine parts. Common alloys are PWA 1426, PWA 1484, PWA 1487, CMSX 4, CMSX 10, René 142, René N5, and René N6. MRO facilities and airlines are key collection points.

Manufacturing processes for rhenium-containing superalloys generate “new scrap” rich in rhenium. This includes punching waste, sheet-metal offcuts, turnings, and casting scrap (gatings, risers). Sintering rhenium alloys also results in valuable rods or residues. Additionally, spent sputtering targets used in coating processes are a source of rhenium scrap. This manufacturing scrap, often with known composition, simplifies identification and segregation, offering immediate circularity.

The petrochemical industry generates spent platinum-rhenium catalysts used in oil refining for the production of high-octane gasoline. Once these catalysts lose efficiency, they are replaced, becoming a significant source of rhenium scrap, including spent catalyst and ash. Though containing lower concentrations (e.g., ~0.3% in Pt-Re catalysts ), their large, consistent volumes make recovery economically viable.

Research and development facilities, including university labs and corporate R&D centers, continuously generate rhenium-containing scrap during experimentation and new alloy development. This can include small quantities of pure rhenium solid scrap, various rhenium-based alloys, and test materials. While individual quantities may be smaller, the material is often well-identified and pure, simplifying recovery.

The diversity and complexity of rhenium scrap (solid alloys, powders, catalysts, sputtering targets, varying concentrations) pose challenges for general recyclers, who often lack specialized analytical capabilities and advanced metallurgical techniques (hydrometallurgy, pyrometallurgy, ion exchange, solvent extraction). This highlights the need for expert partners to maximize value. Recycling “new scrap” from manufacturing offers immediate re-entry into the production cycle, reducing reliance on virgin materials.

Rhenium’s crucial role in various industries makes its recycling a strategic necessity. First and foremost, the rarity and high cost associated with rhenium present significant challenges. This metal is one of the rarest elements on Earth, existing in less than 1 part per billion. It cannot be mined directly; instead, it is primarily produced as a byproduct of molybdenum and copper mining, which ties its availability to the production levels of these base metals. Due to its rarity and indispensable applications, rhenium often commands prices exceeding $10,000 per kilogram, with global annual production limited to 25-30 tons. This scarcity makes recycling a valuable solution, as it can turn disposal costs into revenue while providing a necessary buffer against the instability of primary supply.

Furthermore, the geopolitical realities surrounding rhenium supply exacerbate its market vulnerabilities. Primary production is highly concentrated in just a few countries, with Chile’s Molymet accounting for nearly half of global supply, alongside notable contributions from Poland and the United States. This concentration introduces significant geopolitical risk, meaning disruptions in these regions can have severe effects on both supply and pricing. Given that forecasts expect the global aircraft fleet to double by 2030, alongside a corresponding increase in rhenium demand by 2035, relying solely on primary mining presents a profound strategic weakness. Recycling plays a vital role in this context, providing a domestic or regional supply that reduces reliance on unpredictable international markets, thereby enhancing the security of critical materials.

Moreover, the sustainability aspect of recycling cannot be overlooked. The environmental footprint of primary rhenium extraction is substantial; for instance, mining refractory metals can produce up to 10 tons of waste for every ton of ore extracted. In contrast, recycling significantly reduces the need for new mining activities, lowering carbon footprints and environmental impact. The energy required to produce metals from recycled materials is considerably lower, resulting in up to a 98% reduction in greenhouse gas emissions compared to processing virgin materials. Recycling not only diverts valuable materials from landfills but also aligns well with corporate sustainability objectives.

Finally, ensuring the security of critical materials for future innovation hinges on the role of rhenium. Due to its rarity and vulnerabilities within the supply chain, rhenium is categorized as a vital material, earning a substantial score of 7.7 on an economic distinction scale of 1 to 10 in an EU study. Recycling emerges as a pivotal strategy for securing a stable and sustainable supply of rhenium. By mitigating market fluctuations and reducing geopolitical risks, it fosters long-term technological advancement through diversified supply sources. Furthermore, the significant economic incentive of recycling, given rhenium’s high market price, underscores its importance as a financially rewarding and strategically essential practice for maintaining critical materials security.

Given the complexity, value, and strategic importance of rhenium, its recovery requires specialized expertise. Quest Alloys & Metals is a leading partner, uniquely positioned to help companies unlock the full potential of their rhenium-containing scrap.

The recovery of rhenium is not just economically beneficial; it’s crucial for sustainability. Companies can discover untapped value within their operations, especially in sectors such as Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MROs), smelters, and scrap management. OEMs, for instance, are responsible for generating manufacturing scrap and managing end-of-life components. Many of these companies are already making strides in implementing closed-loop recycling systems. On the other hand, MROs are tasked with handling spent jet engine parts and play a pivotal role in segregating materials for effective recycling.

Smelters contribute by reprocessing collected scrap into high-purity forms, which is essential for rhenium extraction and requires specialized techniques. Meanwhile, scrap managers significantly impact the recovery value by systematically identifying, segregating, and collecting various waste streams.

To optimize rhenium recovery, a collaborative ecosystem is necessary, as no single entity can achieve this alone. This represents a shift in perspective from merely disposing of waste to managing valuable assets. Such an approach offers numerous advantages, including cost reductions, enhanced resource optimization, and improved environmental sustainability. By proactively managing rhenium scrap, companies can strengthen their long-term supply chain resilience, gain a competitive edge, and create new revenue streams.

We encourage organizations within these critical sectors to undertake a comprehensive assessment of their waste streams, decommissioned assets, and manufacturing byproducts. By unlocking the hidden potential of rhenium within their operations and partnering with specialized experts like Quest Alloys & Metals, companies can transform waste into a significant revenue stream. This collaboration not only aids in achieving sustainability goals but also bolsters the supply chain of critical materials, paving the way for a more resilient and profitable future.