Tantalum sits quietly at the center of the digital age. This rare, hard, blue-gray metal is prized for its exceptional resistance to heat, wear, and corrosion, traits that place it among the most valuable refractory metals. With a melting point of 3017 °C and remarkable chemical inertness, it is indispensable to modern electronics, aerospace, energy, and medicine. Yet tantalum’s importance is matched by the fragility and complexity of its supply chain, historically marred by conflict financing, human rights abuses, environmental risks, and market opacity. The industry is now in transition: new, more ethical sources and circular strategies are beginning to stabilize supply, but only if stakeholders embrace a diversified and transparent model.

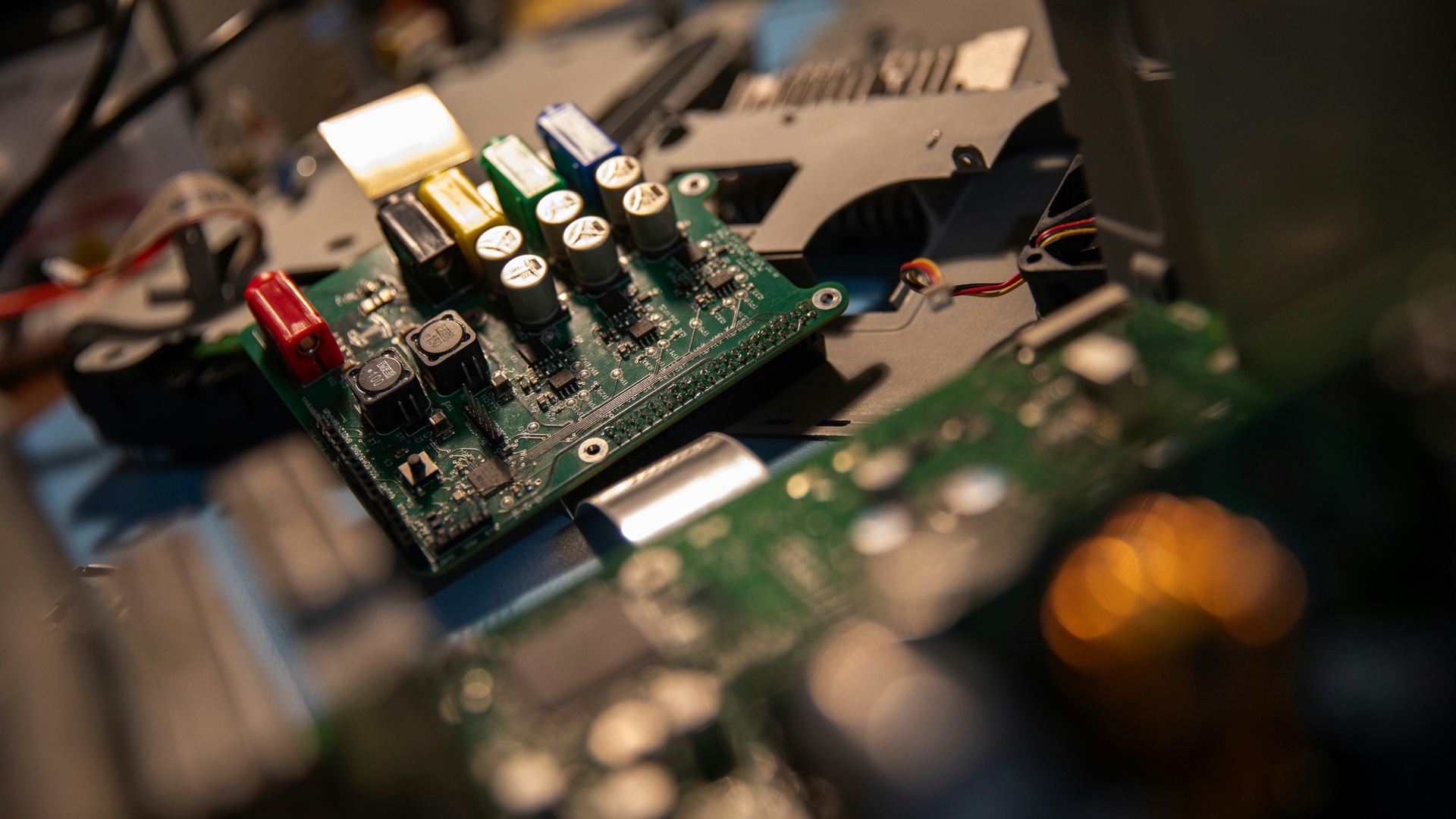

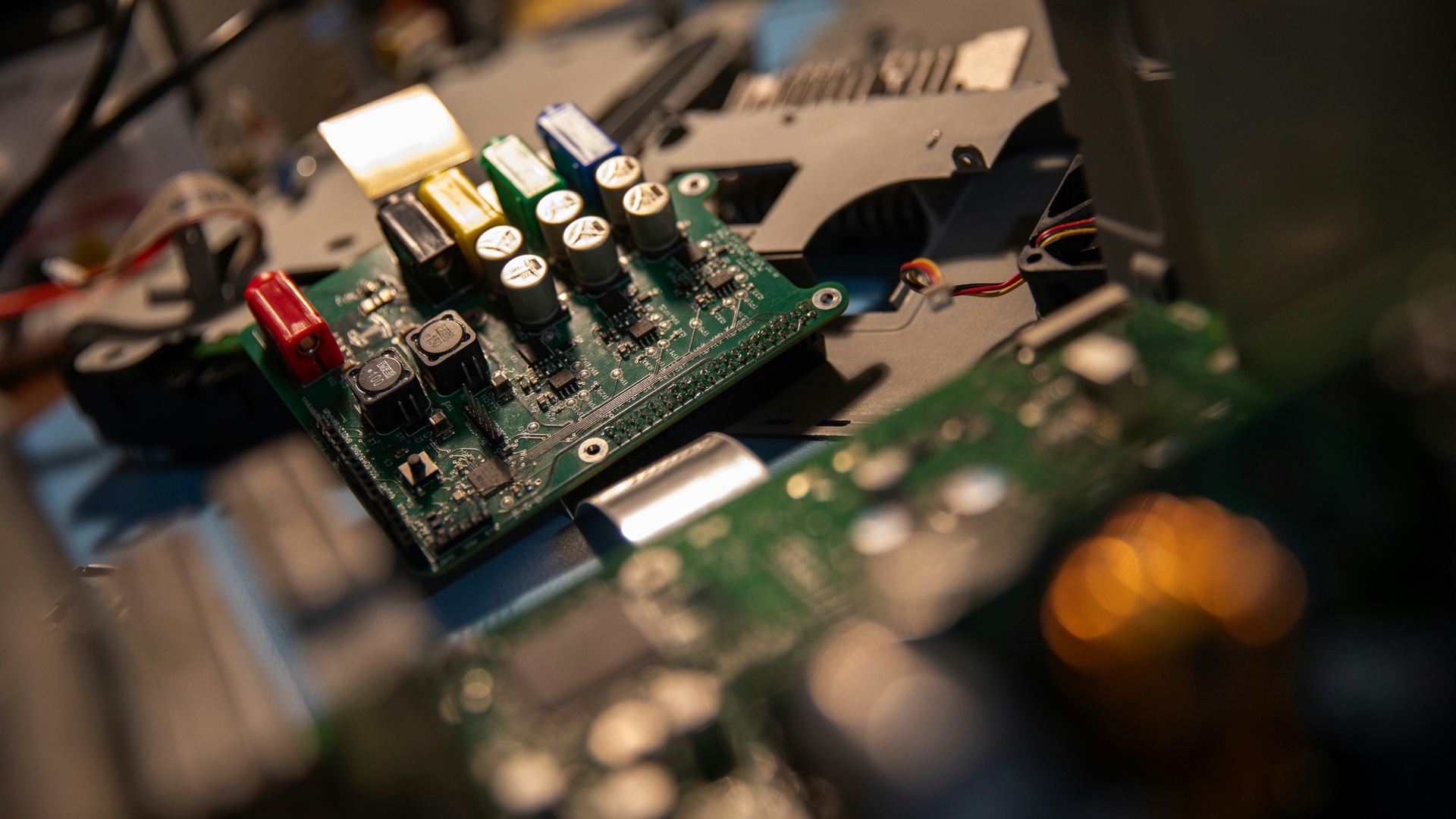

More than half of global tantalum production feeds the electronics industry. Tantalum capacitors, compact, reliable, and thermally stable, are embedded across smartphones, laptops, automotive systems, aerospace electronics, and defense equipment. Tantalum thin films also serve critical roles in semiconductors. Beyond electronics, the metal strengthens high-temperature superalloys for jet engines and turbines, and its biocompatibility makes it a material of choice for surgical instruments and implants. In short, tantalum enables miniaturization, reliability, and performance in the very systems that define modern life.

Tantalum is one of the 3TG minerals (tin, tungsten, tantalum, and gold) formally designated as “conflict minerals,” due to their historic ties to armed conflict and illicit trade, particularly in parts of Central Africa. In the Democratic Republic of Congo (DRC), revenues from the artisanal mining of columbite-tantalite (coltan) have helped finance armed groups, entrenching a cycle of violence and exploitation.

The mechanics of that trade are instructive. In eastern DRC, armed factions have exercised control over mine sites, levied illegal taxes, coerced labor, and smuggled ore into neighboring countries, where it can be relabeled and exported internationally. Tantalum’s high value-to-weight ratio makes it particularly easy to conceal and transport, distinguishing it from more cumbersome commodities and attracting control by non-state armed actors. Weak governance, porous borders, and the ore’s compact value density create an enduring vulnerability: the resource is both economically vital and easily weaponized.

Human and Social Costs

For tens of thousands of people in artisanal and small-scale mining (ASM), tantalum mining is a livelihood of last resort and often a daily hazard. ASM workers commonly contend with unsafe tunnels prone to collapse, unprotected exposure to dust and chemicals, and a lack of basic safety infrastructure. In conflict-affected areas, abuses escalate: miners have reported instances of forced labor, debt bondage via predatory credit, and child labor, all under the shadow of armed groups. The boom-bust cycles typical of artisanal mining can destabilize household incomes and local economies, while conflict dynamics exacerbate gender-based violence and social harm.

Tantalum’s supply is characterized by three main modes of production. The first significant source is artisanal and small-scale mining (ASM), which has historically accounted for roughly 60% of primary tantalum production. This mining occurs primarily in countries such as the Democratic Republic of the Congo, Rwanda, Nigeria, and Brazil, with additional contributions from Burundi, Mozambique, and Ethiopia. ASM is known for its flexibility; however, it is also quite volatile, as it is sensitive to local conditions, fluctuating prices, and the availability of alternative livelihoods for miners. The second mode of production is industrial hard-rock mining, which has been historically predominant in Australia, Brazil, and Canada. This approach continues to serve as a crucial pillar in tantalum supply, with Brazil’s Mibra mine currently recognized as the largest single operating tantalum mine. Significant contributions also come from China and Russia, although Australia’s production tends to be intermittent.

Finally, tantalum is increasingly being sourced from by-product and secondary sources. This includes recovery from tin slag in countries like Brazil, Malaysia, and Thailand. More recently, tantalum has started to be extracted as a by-product from hard-rock lithium mines, with notable production occurring in Western Australia and parts of Africa, and South America. This shift is beginning to reshape the market's stability.

Overall, the dynamics of tantalum supply are further complicated by geopolitical factors. As governments increasingly recognize “critical minerals,” tensions related to trade, resource nationalism, and concentrated production can pose significant risks to supply security. Additionally, the market for tantalum is relatively opaque; in contrast to commodities like tin or gold, tantalum is not widely traded on public exchanges and often relies on private contracts. This lack of transparency makes price discovery and planning more challenging. Collectively, these factors highlight the need for diversification, as reliance on a single source alone does not provide the resilience required by the industry.

The environmental footprint of tantalum mining can be substantial, particularly where oversight is weak. Deforestation, erosion, and water contamination are common near unregulated operations. Some mining has extended into protected areas such as Kahuzi-Biéga National Park in the DRC, threatening biodiversity and undermining conservation efforts.

A less visible but serious hazard is the presence of naturally occurring radioactive materials (NORMs) associated with tantalum-bearing ores. Coltan often coexists with isotopes such as uranium-238 and thorium-232. Without proper controls, tailings and dust can concentrate radionuclides, exposing miners and communities to health risks, including increased rates of certain cancers and congenital anomalies. These challenges exist independently of conflict and reflect deeper geological and public health complexities that demand robust standards in both artisanal and industrial contexts.

Recycling tantalum faces several significant challenges. One major obstacle is the dispersal of tantalum capacitors, which are small and scattered across billions of electronic devices. This makes the collection process both costly and logistically complex. Additionally, the tantalum content in general electronic waste is quite low, often found at trace levels. This low concentration means that a vast quantity of waste must be processed to make recovery economically viable. Furthermore, the complexities involved in separating the tantalum from its encasing materials pose another hurdle. Tantalum cores are typically embedded in resins and surrounded by various metals and oxides, requiring multi-stage processes for effective recovery. These processes include thermal treatment to remove the encapsulants, followed by mechanical separation and chemical reduction – such as the magnesiothermic reduction of tantalum pentoxide. Finally, acid leaching and purification are necessary to achieve high-purity tantalum powders. Given these challenges, recycling should complement rather than replace primary tantalum supply, and scaling recycling efforts will require enhancements in collection infrastructure, advanced sorting techniques, cost-effective pre-concentration methods, and ongoing process innovation..

Co-producing tantalum alongside lithium offers several significant advantages. First, it provides predictable volumes and economic stability, as the tantalum output is closely tied to the rapidly growing lithium market. Additionally, this method has a lower incremental environmental impact, since the processes of mining and crushing are already being performed for lithium extraction. Furthermore, the co-production enhances traceability and compliance, which is particularly beneficial in regions with robust regulatory frameworks. As a result, industries that were once hesitant to incorporate tantalum into their designs due to supply uncertainties are now regaining confidence in its availability.

Regulations have reshaped the market’s priorities. The U.S. Dodd-Frank Act (Section 1502) and the EU Conflict Minerals Regulation require companies to conduct due diligence on 3TG supply chains, increasing transparency and accountability. Enforcement challenges remain, smuggling and on-the-ground abuses have not disappeared, but the broader market effect is significant. By creating demand for audited, conflict-free material, these rules have pushed manufacturers and suppliers to seek alternative sources and invest in traceability. In practical terms, policy pressure catalyzed the development of ethical primary sources, including tantalum recovered as a lithium by-product, and is accelerating investment in recycling.

For corporations, it is essential to adopt multi-sourced procurement strategies that combine audited primary production in stable jurisdictions with robust recycling initiatives. Companies should also invest in traceability measures that go beyond mere compliance, utilizing digital chain-of-custody tools, third-party audits, and smelter or refiner certifications to ensure accountability throughout the supply chain. Additionally, designing products with circularity in mind is crucial; this involves specifying components that facilitate easy end-of-life recovery and pre-concentration of tantalum.

Investors, on their part, should prioritize companies that employ hybrid models integrating responsible primary sourcing with effective recycling practices. They should adopt ESG-aligned due diligence frameworks that assess supply diversity, jurisdictional risks, and verifiable chain-of-custody controls. Furthermore, supporting the development of technologies aimed at sorting, pre-concentration, and low-impact recovery methods is important for advancing these efforts.

For policymakers, it is vital to strengthen and harmonize international due diligence standards and their enforcement to combat illicit trade effectively. Funding research and development, as well as pilot programs focused on advanced electronic waste collection, automated disassembly, and economically viable tantalum recovery methods, is equally important. Encouraging transparency in tantalum markets through disclosure and standardization will enhance price discovery and market stability.

Ultimately, the enduring lesson of tantalum illustrates that ethics, environment, and economics are interconnected. Securing a supply for a technology-driven future hinges on recognizing this relationship and taking appropriate actions to address it accordingly. As industries navigate this complex landscape, partners like Quest Alloys and Metals are essential in providing the responsibly sourced and recycled tantalum needed to build transparent, resilient, and sustainable supply chains for the future.