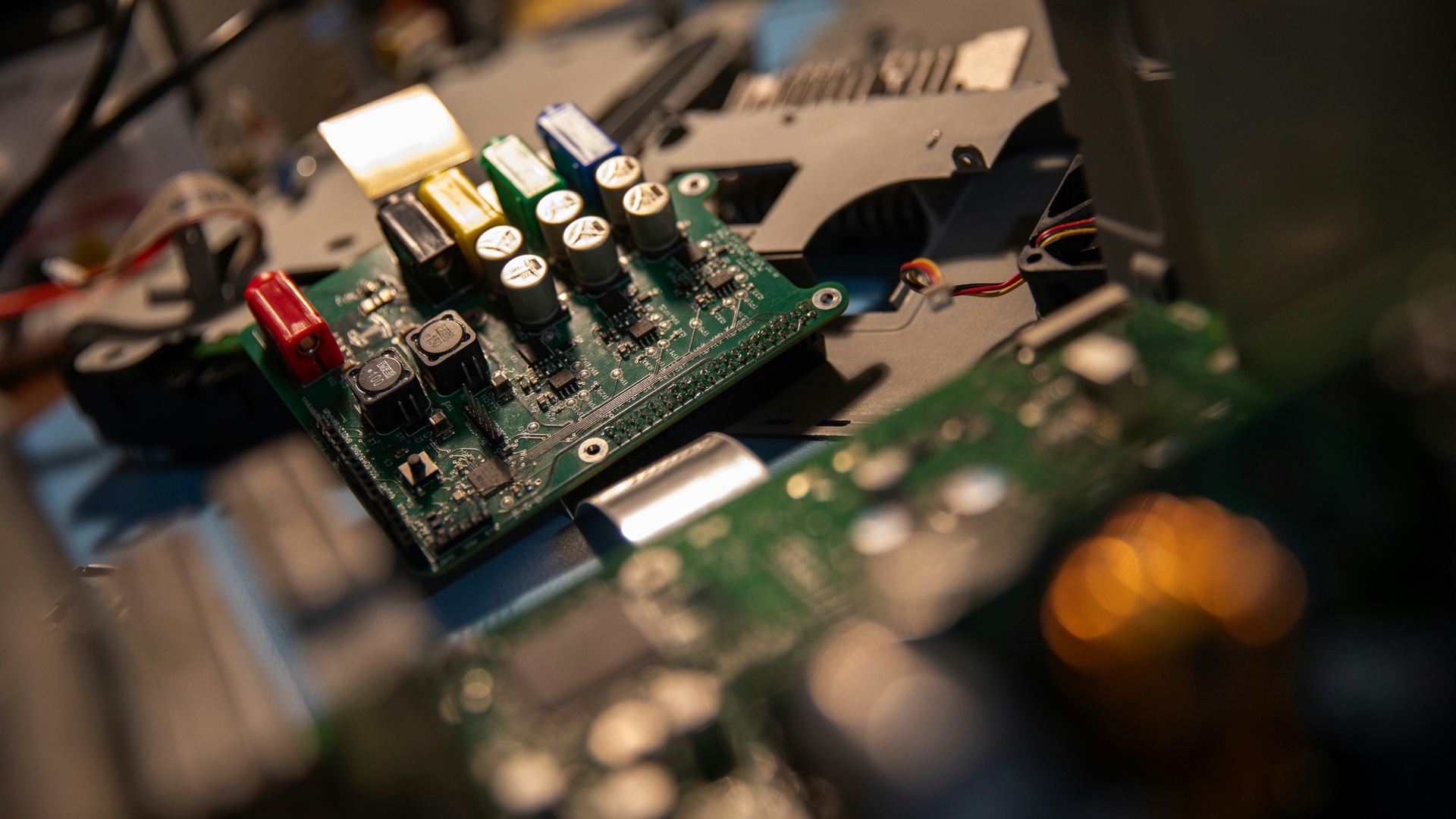

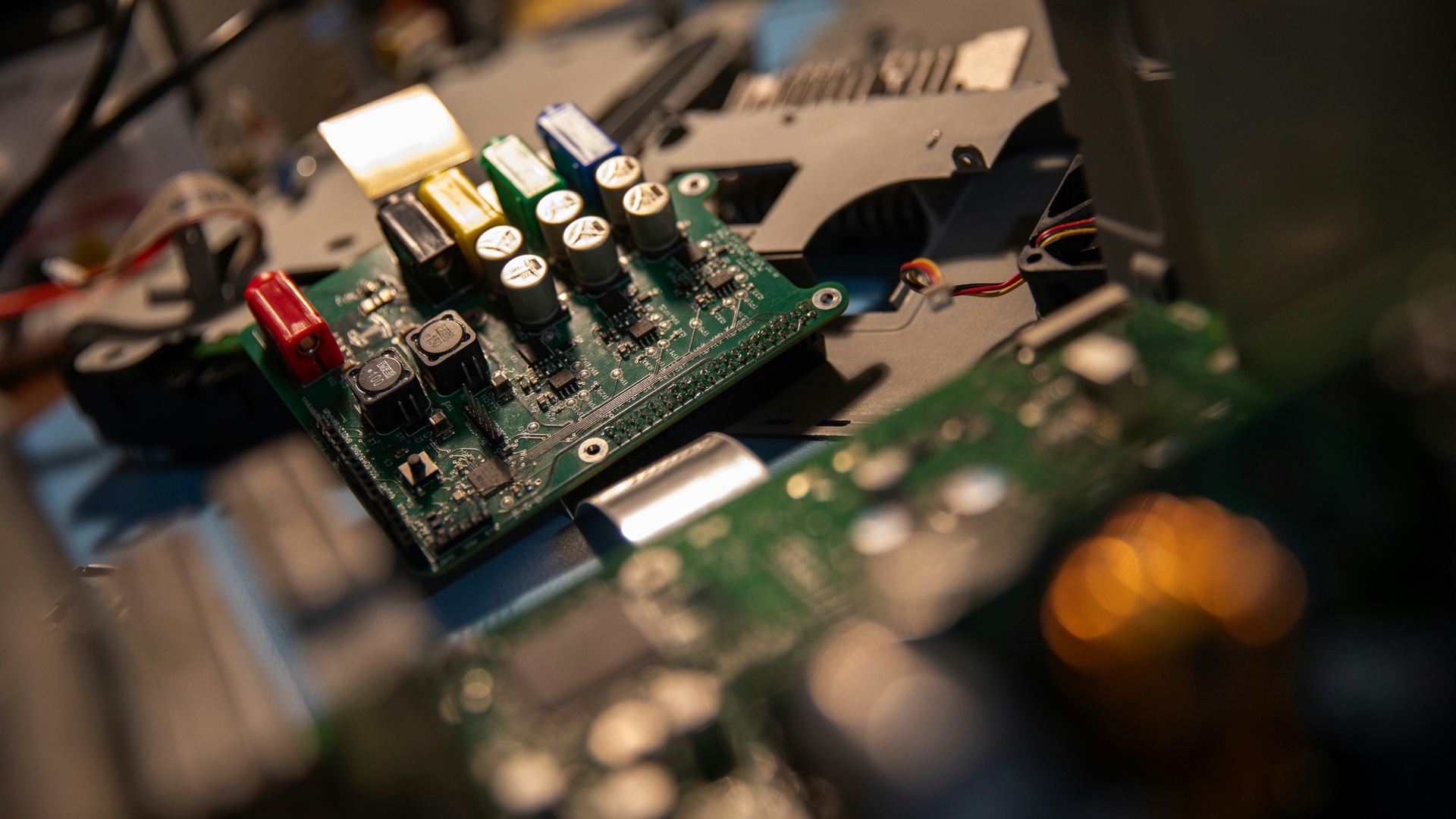

In an era defined by rapid technological advancement and ubiquitous electronic devices, we face a growing challenge: e-waste. The constant cycle of upgrades and the marketing push for the newest gadgets shortens the lifespan of electronics, contributing to millions of metric tons of waste annually, a figure exceeding 52 million metric tons projected for the early 2020s. This e-waste poses significant environmental and health risks, yet it also hides a valuable opportunity. Waste Printed Circuit Boards (WPCBs), the electronic hearts of these devices, are rich repositories of metals, often containing concentrations 10 to 100 times higher than their primary ores. Among the most valuable of these is tantalum.

Tantalum, a rare and critical metal, possesses a unique combination of properties that make it indispensable for modern technology. Its exceptional ability to store electricity in small volumes (high capacitance/unit volume), high dielectric constant (Ta2O5), thermal stability across a wide temperature range, and excellent oxidation resistance make it ideal for high-performance capacitors. These capacitors are crucial components in densely packed electronics like smartphones, laptops, notebooks, and digital cameras, enabling the ongoing trend of miniaturization. Beyond capacitors (which accounted for ~34% of tantalum in 2016), it has vital applications in superalloys for aerospace, chemical processing equipment, semiconductor sputtering targets, and specialized mill products. However, this reliance comes at a cost; tantalum faces significant supply challenges, driving an urgent need for efficient recycling.

Tantalum’s journey from ore to product is both intricate and challenging. Unlike many elements, tantalum does not occur naturally; instead, it is found in complex minerals such as tantalite and columbite, commonly referred to collectively as “coltan.” These minerals predominantly contain tantalum pentoxide (Ta2O5) and are often associated with chemically similar niobium, which complicates primary extraction. This process is usually difficult, energy-intensive, and costly. Despite Brazil holding the largest known reserves of tantalum—nearly 59%—global production has seen considerable shifts over the years.

Historically, tin slags were a significant source of tantalum, contributing over 50% of the supply during the 1970s and 80s. However, this figure has declined dramatically to around 25% as market dynamics changed and reliance on mined concentrates increased. A key transformation in production occurred in the late 2000s when many large-scale mines (LSM) in developed countries, such as Australia and Canada, shut down due to ore degradation, rising costs, and the impacts of the global financial crisis. Subsequently, production began shifting towards artisanal and small-scale mining (ASM), primarily in the Democratic Republic of the Congo (DRC) and Rwanda. By 2018, these ASM operations had emerged as the dominant source of tantalum, accounting for approximately 48% of global supply, with the DRC and Rwanda alone contributing over 60% of global mine production in the late 2010s. Meanwhile, conventional mining accounted for about 25%, recycling for about 20%, and tin slags for only about 7% of the total supply.

This dependence on specific regions, particularly those prone to conflict, adds volatility to the supply chain. Overall, primary mine production has struggled to keep up with the growing demand for tantalum. For example, in 2016, mine production was reported at 1,220 tons, which fell considerably short of the estimated 2,000 tons required.

As supply sources shifted, demand patterns also evolved. Since the 1970s, overall demand for tantalum has grown significantly, though economic recessions have punctuated this growth. Capacitors have consistently remained the largest segment consuming tantalum. However, its use in carbides has declined from approximately 30% in the late 1990s to around 7% in 2016. This decline can largely be attributed to the substitution of tantalum with cheaper materials and to increased recycling efforts. Looking ahead, future demand is expected to be primarily driven by the chemical sector, sputtering targets, and, particularly, the superalloy market, which is projected to grow at 4.6% per year for alloys used in aircraft and turbine applications. Overall, demand for tantalum is expected to reach 2,800 tons by 2026.

Tantalum capacitors offer superior performance characteristics: high volumetric efficiency, excellent stability, reliability, and good frequency response. A typical tantalum capacitor consists of a sintered anode made from high-purity tantalum powder (>90%), onto which a dielectric layer of tantalum pentoxide (Ta2O5) is formed. A cathode layer (often manganese dioxide or conductive polymer, overlaid with graphite and silver paste) completes the capacitive structure. This core is encased in a protective mold housing (typically epoxy or phenolic resin mixed with silica) and connected via Ni-Fe terminals.

Despite their advantages, tantalum capacitors have faced challenges. Price spikes and supply disruptions, linked to the metal’s scarcity and geopolitical issues, spurred efforts to replace them with alternatives such as Multilayer Ceramic Capacitors (MLCCs) and aluminum electrolytic capacitors. While these substitutes offer advantages in certain areas (e.g., lower ESR for MLCCs), they also have drawbacks (e.g., capacitance instability or aging), underscoring the need for tantalum capacitors in demanding applications. Interestingly, substitution efforts led to a subsequent drop in tantalum capacitor prices, encouraging their reuse in some designs. The distribution of tantalum in electronics varies, with older data (2013) indicating that notebooks and desktop PCs had the largest potential pool, followed by smartphones and tablets with smaller amounts.

Despite the clear advantages of recycling tantalum, particularly from waste tantalum capacitors, several key barriers contribute to the disappointingly low rates of post-consumer tantalum recycling, which remain below 1%. One of the primary challenges is the low overall concentration of tantalum in complex waste printed circuit boards (WPCBs). While tantalum content is high within the capacitors themselves, it constitutes a small percentage when compared to more abundant metals like copper and gold, making targeted recovery efforts less attractive.

Additionally, traditional pyrometallurgical methods used for bulk processing of WPCBs often lead to significant processing losses. During these methods, tantalum can be lost to the slag phase as an oxide, further reducing recovery efficiency. The trend of miniaturization in electronic components poses another obstacle; as capacitors get increasingly smaller, they become more difficult to identify, manage, and process mechanically.

Lastly, the robust epoxy and phenolic housing that encases the tantalum core presents a major hurdle. This mold resin is challenging to remove, complicating the recycling process. Despite these challenges, advancements in targeted hydrometallurgical techniques and other innovative methods are beginning to improve recovery rates. As a result, the contribution of recycling to the tantalum supply, which reached 20% in 2018, is expected to grow in the coming years.

Researchers have developed various strategies focused primarily on overcoming the challenge of removing the protective mold resin and liberating the valuable tantalum anode. Key methods include:

Tantalum remains a cornerstone of modern high-performance electronics. Its criticality, coupled with significant supply chain vulnerabilities and growing demand, underscores the urgent need for robust and sustainable recycling pathways. Waste tantalum capacitors, with their high concentration of the metal, represent the most logical and valuable secondary resource. While significant challenges remain, particularly in efficiently and economically removing the protective mold resin and handling miniaturized components, research is yielding promising solutions.

Technologies like pyrolysis stand out for their potential efficiency and environmental credentials, while others, such as ionic liquids and supercritical water, offer unique chemical advantages. Continued innovation and investment in these recovery methods are essential. Establishing effective collection systems and integrating these advanced recycling techniques into the broader e-waste management infrastructure will be key to closing the loop, reducing reliance on primary mining, mitigating environmental impact, and ensuring a stable supply of this indispensable metal for the technologies of tomorrow.