In the wake of optimistic news that the United States and China appear poised to delay a new round of economic retaliations, rare earth stocks plunged sharply Monday, reversing some of the major gains seen earlier this year. Investors reacted quickly to comments from U.S. Treasury Secretary Scott Bessent, who signaled that Beijing is expected to defer newly expanded export controls on rare earth minerals for at least a year as part of a broader trade truce currently under negotiation.

This development comes just days ahead of a high-stakes meeting scheduled between U.S. President Donald Trump and Chinese leader Xi Jinping during the Asia-Pacific Economic Cooperation (APEC) summit in Gyeongju, South Korea. The meeting is widely expected to confirm the framework of a preliminary trade deal that would stave off proposed 100% tariffs on Chinese imports set to take effect on November 1, while simultaneously delaying China's implementation of rare earth export restrictions that had alarmed Western industries.

U.S.-listed rare earth miners bore the brunt of the market’s sharp pivot. Critical Metals sank 17.6% in early trading, USA Rare Earth fell around 12%, and MP Materials dropped 7.3%. Other sector players, such as Trilogy Metals and NioCorp Developments, also posted double-digit percentage losses. The pullback is widely seen as a direct response to waning concerns over short-term disruptions in global supply chains for critical minerals.

“Markets had priced in further escalation between the U.S. and China. Now with the immediate threat of export controls and 100% tariffs off the table, speculative momentum has evaporated, and investors are recalibrating,” said Wolfe Research analyst Tobin Marcus.

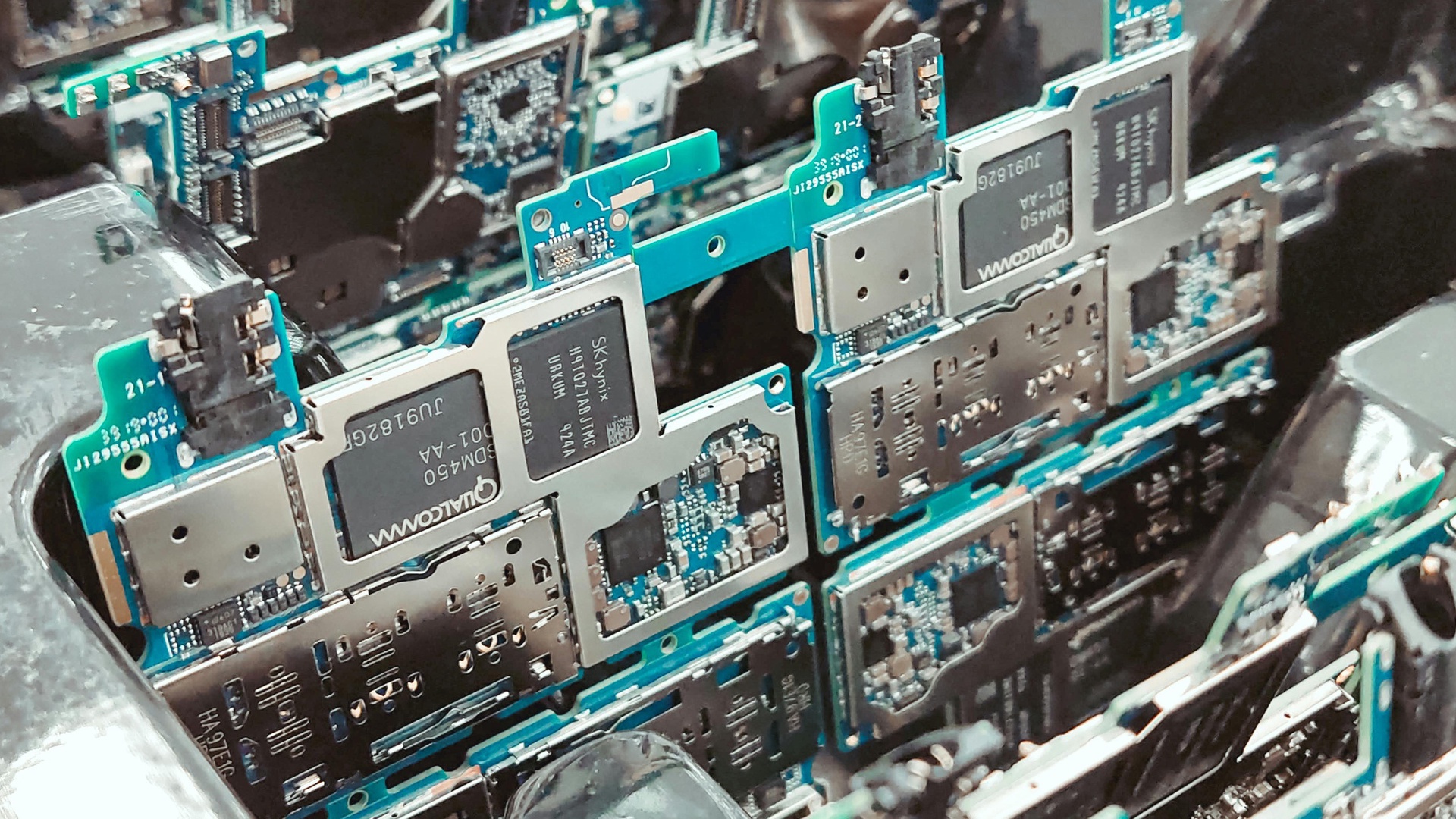

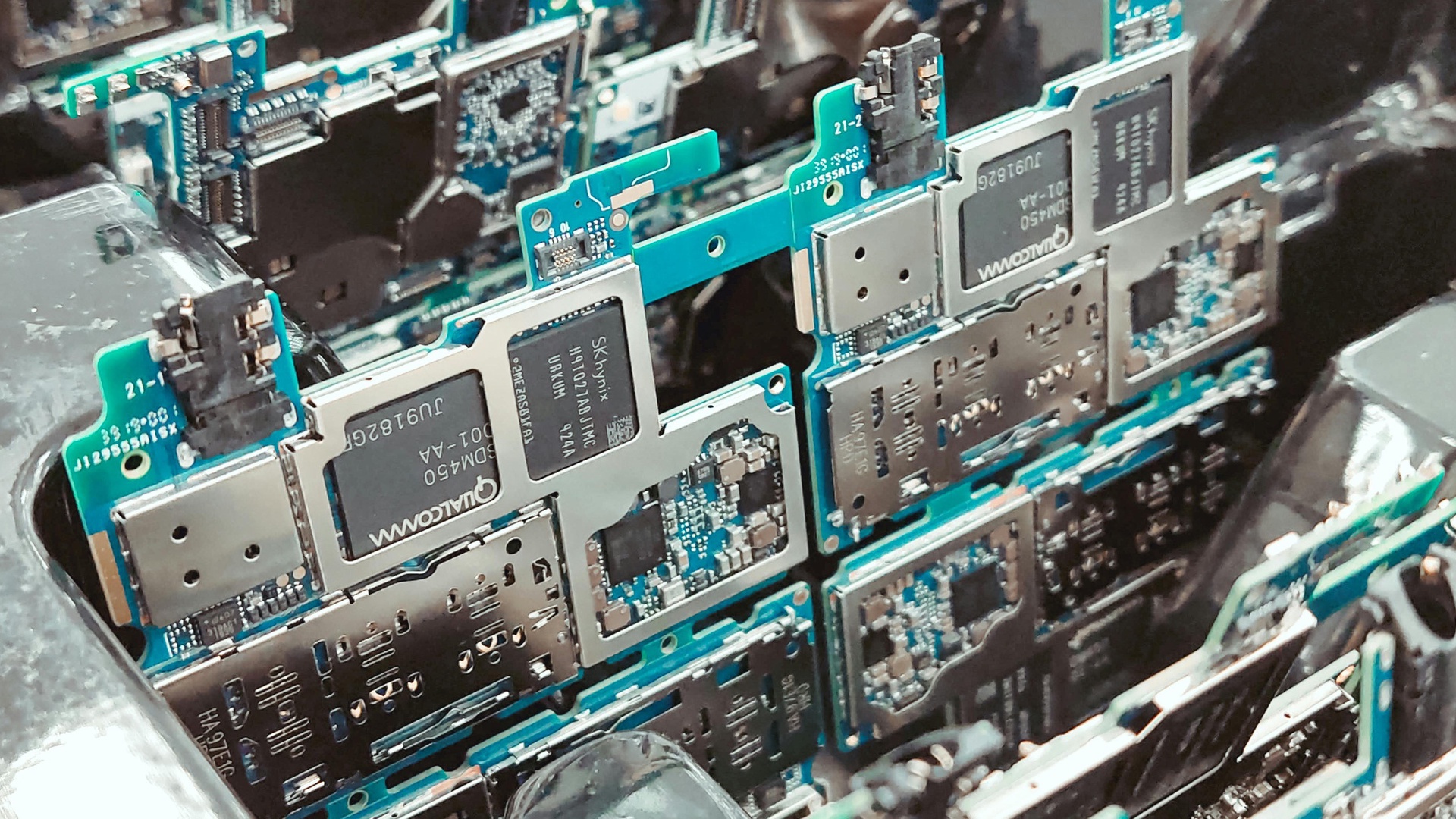

Despite the truce in sight, analysts warn that the broader strategic tensions between the two global superpowers remain unresolved, particularly in the realm of critical minerals. China currently controls approximately 70% of mined rare earth production and more than 90% of global processing. These minerals are indispensable for the production of electric vehicles, smartphones, medical devices, and military hardware, making China's dominance a longstanding concern for Washington.

Earlier this month, China enacted sweeping updates to its rare earth export governance framework, expanding the list of controlled elements and tightening oversight of shipments even containing trace amounts of Chinese-origin inputs or processed using Chinese technology. The move was widely interpreted as a warning shot in the context of collapsing mutual trust between Beijing and Washington.

“Beijing still holds enormous leverage over global supply chains,” said Dexter Roberts, senior fellow at the Atlantic Council. “Delaying the licensing regime by a year is a tactical pause, not a strategic retreat.”

U.S. officials have framed the current deal as a “substantial framework” that will prevent further escalation, at least temporarily. According to Bessent, the U.S. and China have agreed to pause punitive actions, including Washington’s proposed 100% tariff hike and China’s implementation of its strict rare earth licensing system. The deal also includes the Chinese resumption of U.S. soybean purchases and ongoing negotiations over the ownership transfer of TikTok’s American operations.

"We think we're going to have a deal with China," said Trump aboard Air Force One en route to Japan for his Asia tour. He also praised Xi Jinping as “a very strong leader," signaling his intent to maintain a conciliatory tone ahead of the summit.

Still, top Chinese officials have adopted a more reserved stance. Chinese Vice Premier He Lifeng and trade envoy Li Chenggang referred to the agreement as a “preliminary consensus,” noting that each side must go through internal channels before finalizing any deal.

Economic analysts caution that the current truce leaves fundamental issues unaddressed. Deep-rooted disputes concerning trade imbalances, industrial subsidies, tech competition, and national security remain flashpoints. Some experts argue that the “easy wins” in this agreement, such as resuming soybean purchases and delaying tariffs, only defer tougher decisions.“There’s a ceasefire going on. It doesn’t mean there’s disarmament,” said Mary Lovely, a senior fellow at the Peterson Institute for International Economics. “Tariffs and critical resource controls are tools that both sides are keeping within arm's reach.”

The lack of clarity surrounding the exact terms of China's one-year delay on rare earth restrictions has also fueled skepticism. Export curbs asserted sweeping control over rare-earth-based items shipped globally, a mechanism many analysts questioned from a logistical enforcement standpoint.

The United States has only one operational rare earth mine at present and lacks sufficient domestic processing infrastructure, underlining its continued dependence on China’s supply chain. Although the Biden and now Trump administrations have launched investment initiatives and struck equity deals with companies like MP Materials, Critical Metals, and USA Rare Earth, significant progress remains years away.

Earlier this month, Trump announced a series of rare earth supply agreements with Japan, Pakistan, and Australia totaling over $9 billion. While these deals are steps toward diversifying supply chains, industry observers say the timeline for meaningful results may be measured in decades. The Trump-Xi summit in South Korea will be laden with symbolism and consequences. The rare earth element pause offers a critical moment of détente, but experts agree it’s unlikely to signify a lasting resolution.

“Most countries don’t want to see the U.S. and China fight each other,” said Zichen Wang of China’s Center for China and Globalization. “When the elephants fight, it is the grass that suffers.”

Indeed, the global technology, defense, and energy sectors will be watching closely for the outcomes of Thursday’s summit. For now, investors remain cautious, and rare earth equities have sobered after a high-flying year fueled by geopolitical anxiety.

In the short term, stability may return to rare earth markets. But as past rounds of trade diplomacy have shown, any ceasefire between the U.S. and China remains conditional and fragile. Whether this tentative framework becomes the gateway to broader cooperation or simply another pause in an ongoing strategic rivalry remains to be seen.