At the heart of a tantalum capacitor is an anode fabricated from compacted tantalum powder. This undergoes anodic oxidation, forming a thin but robust layer of tantalum pentoxide (Ta₂O₅), which serves as the capacitor’s dielectric. Ta₂O₅’s high dielectric constant allows capacitors to store substantial charge within a compact volume, making tantalum capacitors ideally suited for small, power-sensitive electronic devices.

Beyond capacitors, tantalum finds application in advanced electronics and industrial systems. It serves as a diffusion barrier in semiconductors, shields cutting tools with wear-resistant coatings, and forms biocompatible medical implants such as pacemakers and surgical staples. These features ensure that tantalum holds a niche in medical, aerospace, and high-performance engineering sectors where reliability is non-negotiable.

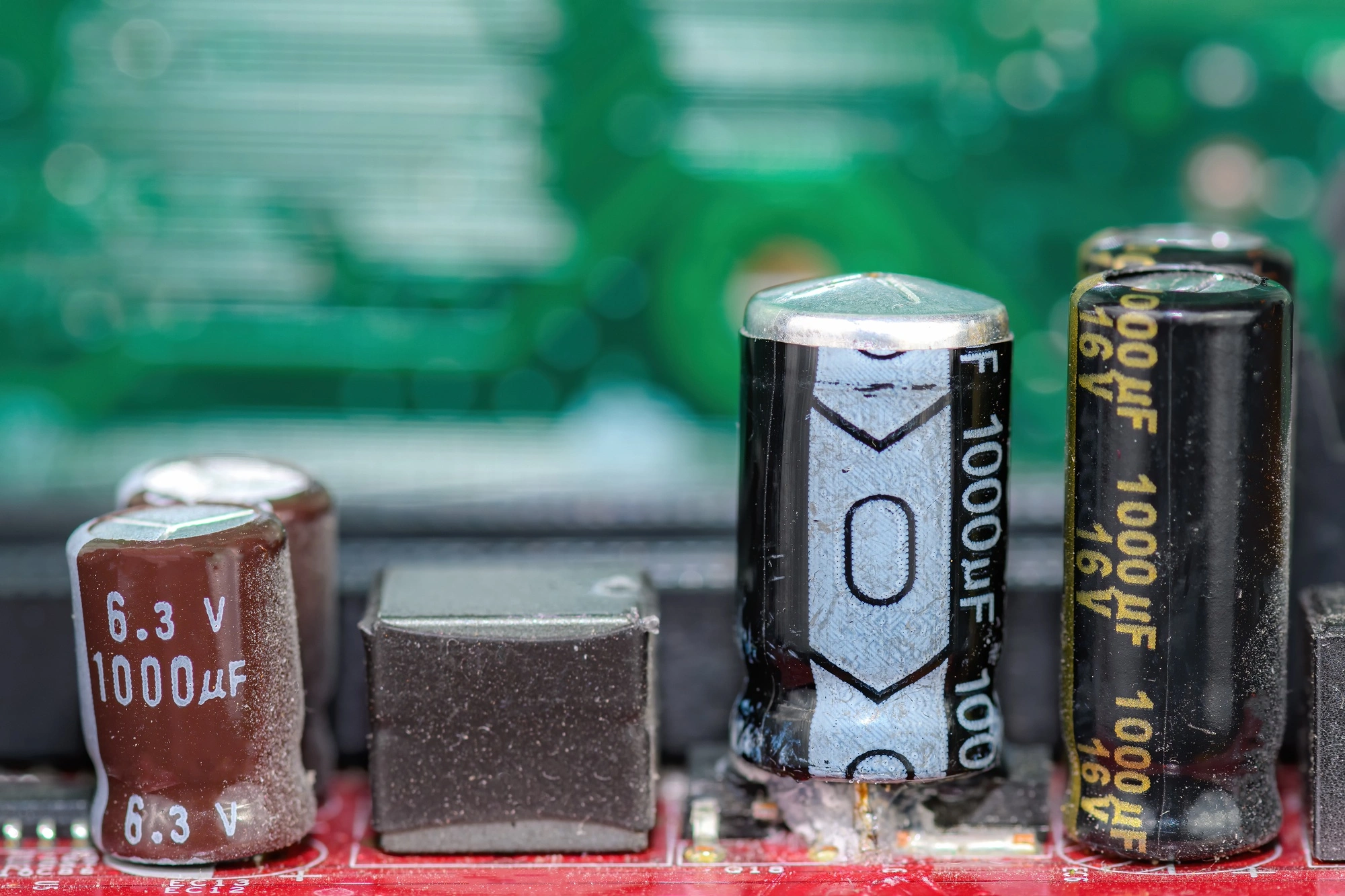

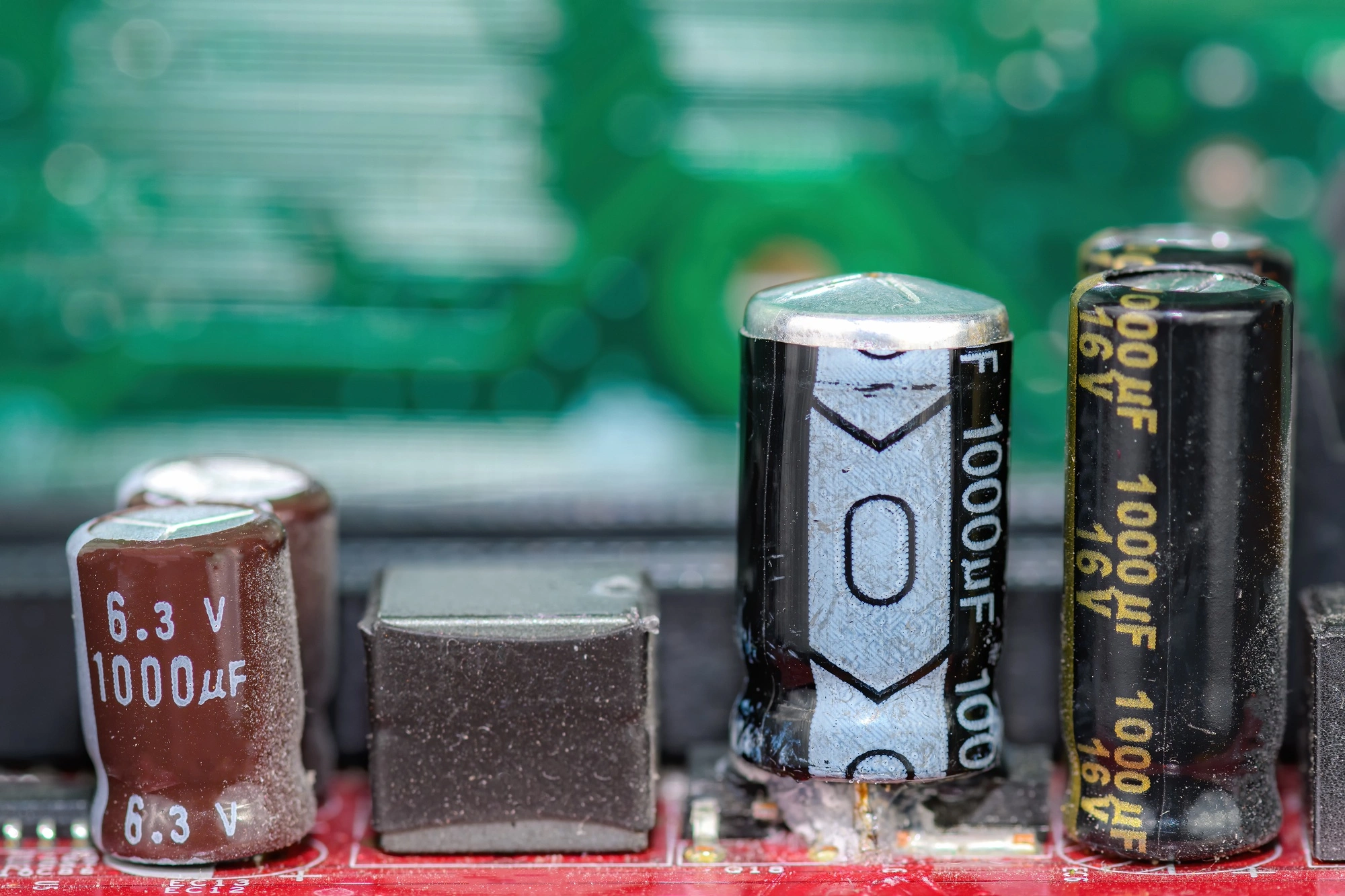

The value of tantalum becomes most apparent when compared with other capacitor materials particularly ceramic MLCCs and aluminum electrolytics.

Multilayer ceramic capacitors (MLCCs) dominate consumer electronics, but they come with compromises. MLCCs suffer significant capacitance loss at high temperatures or under voltage stress (a behavior known as the voltage coefficient of capacitance). Tantalum capacitors, in contrast, maintain stable performance across a broad range of temperatures and operational conditions, making them critical for high-reliability applications. Furthermore, tantalum capacitors offer dramatically higher volumetric efficiency, storing more energy in a smaller footprint. However, they are polarized and must be carefully oriented on PCBs, whereas MLCCs are non-polarized.

Tantalum capacitors also outperform aluminum electrolytics in size, ESR (Equivalent Series Resistance), and self-discharge rate. Their low ESR makes them ideal for processes requiring high current and minimal signal noise perfect for power management in modern digital circuits. However, tantalum capacitors can fail catastrophically if misused, requiring cautious design and voltage derating, unlike aluminum capacitors that offer more tolerable failure modes.

Niobium capacitors present an intriguing alternative, offering safer, non-igniting failure modes and a lower price point due to greater abundance. However, they fall short in voltage ratings and volumetric efficiency, limiting their use to low-power applications.

Meanwhile, X2Y Attenuator technology introduces a novel ceramic architecture that minimizes both ESR and ESL, potentially replacing multiple MLCCs with a single unit. This innovation, while not a material substitute, pushes the technological frontier and challenges the dominance of tantalum in specific decoupling tasks.

Overall, these comparisons reveal a bifurcated market. High-reliability and mission-critical fields continue to rely on tantalum for performance advantages that no low-cost alternative can currently match. In contrast, the low-cost, high-volume consumer electronics market continues to experiment with emerging substitutes.

The demand for tantalum is expected to accelerate alongside innovations across several sectors. One significant area is the growth of 5G and the Internet of Things (IoT), where the proliferation of connected devices creates a need for high-frequency and energy-efficient components. Tantalum capacitors are particularly well-suited for these environments due to their compactness and stability.

Another sector driving demand is the electric vehicle (EV) market. Within EV platforms, components such as battery management systems and powertrains require stable and miniaturized parts that can operate effectively under challenging conditions. Tantalum's importance in these applications is increasing, with the automotive capacitor market projected to grow at a compound annual growth rate (CAGR) of 5.13% through 2030.

Additionally, cloud data centers are a crucial market for tantalum capacitors as they help ensure power quality and maintain mission-critical uptime for servers, especially in hyperscale computing environments. The interconnection of these technological advancements highlights the growing significance of tantalum across various high-demand industries.

The United States is currently reevaluating its domestic capabilities in tantalum processing, highlighted by initiatives such as the partnership between the Department of Defense and Global Advanced Metals, which aims to enhance upstream processing. Similarly, the European Union is taking significant steps with its Critical Raw Materials Act, which establishes ambitious targets for sourcing, refining, and recycling to achieve supply chain autonomy by the year 2030. On the other hand, China, as a leading processor and consumer of tantalum, is concentrating on improving internal efficiency and adopting circular economy practices to reduce market volatility. This dynamic creates two distinct market systems: one that prioritizes transparency and auditability, and another that focuses on maximizing cost-efficiency, often without regard for ethical sourcing.

Despite the significant value of tantalum, currently less than 1% of this material is recycled. This low recycling rate is largely due to the technical challenges involved in extracting tantalum from small, encapsulated components. However, innovative processes, including oxidation, pyrolysis, and ionic liquid extraction, are starting to pave the way for large-scale reclamation of this vital resource. Companies like Global Advanced Metals and Taniobis are making substantial investments in end-of-life recovery efforts, which are helping to shift the market toward more sustainable and conflict-free circular supply chains.

On the other hand, niobium presents an alternative with promising strategic potential, offering safer failure modes at lower costs for certain applications. Additionally, advancements such as Multi-layer Ceramic Capacitors (MLCCs) and architectural innovations like X2Y provide valuable trade-offs in terms of size, cost, and reliability. However, it is important to note that none of these substitutes have yet been able to replicate the complete performance profile of tantalum. Consequently, substitution tends to serve as a solution specific to certain sectors rather than a universal answer across all applications.

Tantalum is a cornerstone of the high-tech economy, enabling the modern age of miniaturized electronics, infrastructure computing, medical innovation, and defense technology. But its strategic importance is matched by pronounced vulnerabilities ethical concerns, geographic concentration, and fragile supply chains.

To secure a stable future for electronics manufacturing, stakeholders must engage in proactive reshaping of how tantalum is sourced, processed, and reused. Investment and policy must foster a circular, transparent, and diversified value chain. As industries strive for secure and sustainable access to critical materials, companies like Quest Metals stand ready to meet those needs offering traceable, conflict-free, and strategically refined tantalum, tailored to power the next generation of global innovation.